The Best International Tax Planning solutions since 1991 |

A A |

| HOME > Services > Cyprus - all in one > Description > | |

The Cyprus Tax System

- Corporate Tax

- Withholding Taxes

- Tax Treaties Withholding Tax Tables

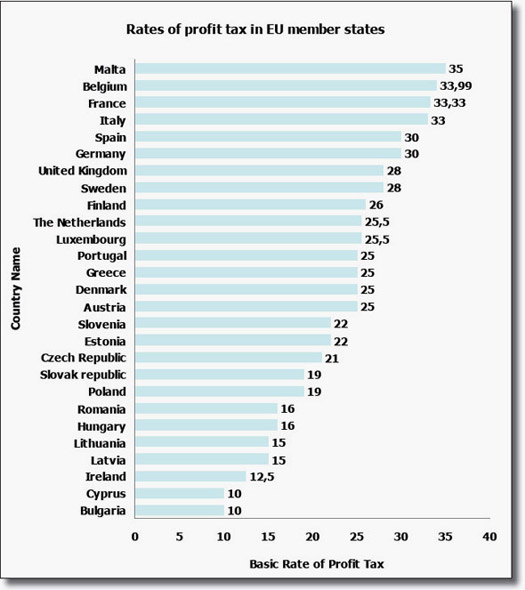

- Comparison of EU tax rates

- VAT Regulations

- Personal Income Tax Regulations

- Capital Gains Tax

| Royalties |

Fees arising from the profitability of rights held in Cyprus are taxable in Cyprus.

The rate of tax is 10%, and 5% in the case of film royalties, unless there is a valid agreement for the avoidance of double taxation signed by Cyprus - and which is applicable in the given case - stipulating a lower figure. Royalties arising outside Cyprus are not taxable in Cyprus. |

| Dividends |

According to Cypriot tax laws, dividends paid to non-Cypriot tax residents are exempt from dividend tax.

At the end of the financial year, once the company has paid its corporation tax, its foreign owners are free to take their share of the profits out of the company and out of Cyprus. These profits may, of course, also be re-invested. |

| Interest |

The total amount of interest paid to non-Cypriot tax residents is exempt from tax in Cyprus (unlike many other EU member countries, Cyprus does not employ regulations on under-capitalisation in domestic tax laws).

Income of non-resident professionals, entertainer and athletes from activities in Cyprus are taxable at a rate of 10%. |

The following tables give a summary of the withholding taxes provided by the double tax treaties entered into by Cyprus.

Cyprus Table of Treaty Rates:

Excluding treaties not yet in force; references to notes are in parentheses after the rates and apply to payments in both directions unless otherwise specified; all rates are percentages.

EU Directives may have the effect of reducing withholding taxes to zero.

Cyprus does not withhold taxes on payments of dividends and interest to non-residents.

>

| Country | Dividends | Interest | Royalties | |||

|---|---|---|---|---|---|---|

| Rcvd. in Cyprus | Paid from Cyprus | Rcvd. in Cyprus | Paid from Cyprus | Rcvd. in Cyprus | Paid from Cyprus | |

| Armenia | 0 | 0 | 0 | 0 | 0 | 0 |

| Austria | 10 | 10 | 0 | 0 | 0 | 0 |

| Belarus | 5/10/15 (1) | 5 | 5 | 5 | 5 | 5 |

| Belgium | 10/15 (2) | 10/15 (2) | 0/10 (3) | 0/10 (3) | 0 | 0 |

| Bulgaria | 5/10 (4) | 5/10 (4) | 0/7 (3) | 0/7 (3) | 10 (5) | 10 |

| Canada | 15 | 15 | 0/15 (3) | 0/15 (3) | 0/10 (6) | 0/10 (6) |

| China | 10 | 10 | 10 | 10 | 10 | 10 |

| Czech Rep. | 10 | 10 | 0/10 (3) | 0/10 (3) | 0/5 (7) | 0/5 (7) |

| Denmark | 10/15 (2) | 10/15 (2) | 0/10 (3) | 0/10 (3) | 0 | 0 |

| Egypt | 15 | 15 | 15 | 15 | 10 | 10 |

| France | 10/15 (2) | 10/15 (2) | 0/10 (3) | 0/10 (3) | 0/5 (8) | 0/5 (8) |

| Germany | 10/15 (2) | 10/15 (2) | 0/10 (3) | 0/10 (3) | 0/5 (8) | 0/5 (8) |

| Greece | 25 (9) | 25 | 10 | 10 | 0/5 (8) | 0/5 (8) |

| Hungary | 5/15 (2) | 5/15 (2) | 0/10 (3) | 0/10 (3) | 0 | 0 |

| India | 10/15 (10) | 10/15 (10) | 0/10 (3) | 0/10 (3) | 10/15 (11) | 10/15 (11) |

| Ireland | 0 | 0 | 0 | 0 | 0/5 (8) | 0/5 (8) |

| Italy | 15 | 0 | 10 | 10 | 0 | 0 |

| Kirgistan | 0 | 0 | 0 | 0 | 0 | 0 |

| Kuwait | 10 | 10 | 0/10 (3) | 0/10 (3) | 0/5 (7) | 0/5 (7) |

| Lebanon | 5 | 5 | 0/5 (3) | 0/5 (3) | 0 | 0 |

| Malta | Note 12 | 15 | 0/10 (3) | 0/10 (3) | 10 | 10 |

| Moldova | 5/10 (20) | 5/10 (20) | 5 | 5 | 5 | 5 |

| Montenegro | 10 | 10 | 10 | 10 | 10 | 10 |

| Mauritius | 0 | 0 | 0 | 0 | 0 | 0 |

| Norway | 0/5 (13) | 0 | 0 | 0 | 0 | 0 |

| Poland | 10 | 10 | 0/10 (3) | 0/10 (3) | 5 | 5 |

| Romania | 10 | 10 | 0/10 (3) | 0/10 (3) | 0/5 (7) | 0/5 (7) |

| Russia | 5/10 (14) | 5/10 (14) | 0 | 0 | 0 | 0 |

| San Marino | 0 | 0 | 0 | 0 | 0 | 0 |

| Serbia | 10 | 10 | 10 | 10 | 10 | 10 |

| Seychelles | 0 | 0 | 0 | 0 | 5 | 5 |

| Singapore | 10 | 10 | 10 | 10 | 10 | 10 |

| Slovakia | 10 | 10 | 0/10 (3) | 0/10 (3) | 0/5 (7) | 0/5 (7) |

| Slovenia | 10 | 10 | 10 | 10 | 10 | 10 |

| South Africa | 0 | 0 | 0 | 0 | 0 | 0 |

| Sweden | 5/15 (2) | 5/15 (2) | 0/10 (3) | 0/10 (3) | 0 | 0 |

| Syria | 0/15 (2) | 0/15 (2) | 0/10 (3) | 0/10 (3) | 10/15 (15) | 10/15 (15) |

| Tadzikistan | 0 | 0 | 0 | 0 | 0 | 0 |

| Thailand | 10 | 10 | 10 | 10 | 5/10/15 (16) | 5/10/15 (16) |

| Ukraine | 0 | 0 | 0 | 0 | 0 | 0 |

| UK | 15 (9) | 15 (9) | 10 | 10 | 0/5 (17) | 0/5 (17) |

| USA | 5/15 (18) | 0 | 0/10 (19) | 0/10 (19) | 0 | 0 |

| Uzbegistan | 0 | 0 | 0 | 0 | 0 | 0 |

- 5% if investment in Belarus company exceeds €200.000. 10% if investment is less than €200.000 but control exceeds 25%. 15% in all other cases.

- 15% if control is less than 25% in foreign company

- 0% if recipient is a state organisation

- 10% if control is less than 25% in Bulgarian company

- Not applicable if Bulgarian interest in Cyprus company exceeds 25% and Cyprus company is taxed at lower than normal rates

- 0% if in respect to production of theatrical, musical or artistic work, except from television films.

- 0% if in respect to production of theatrical, musical or artistic work including cinematographic films

- 5% for cinematographic or television films

- 0% according to national legislation

- 15% if control is less than 10%

- 10% on payments of technical, management or consulting services

- Withholding tax on dividends shall not exceed tax on underlying profits

- 0% if control of Norwegian company is at least 50%

- 10% if investment in foreign company is less than US$100.000

- 10% for artistic or scientific work, cinematographic and television films

- 10% for right to use, or information concerning industrial, commercial or scientific equipment. 15% for patent royalties, brands and industrial methods

- 5% for cinematographic or television films

- 5% if control in US company exceeds 10% and the income of the US company does not comprise interest or dividends exceeding 25% of total income, unless such interest or dividends is received from subsidiary companies.

- 0% if interest is payable to a government or financial institution or in connection with debts accruing from the sale of property or the rendering of services or in connection with loans guaranteed by government.

- 5% if beneficial owner of the dividends is a limited liability company holding at least 25% of the shares of the remitter company

Comparison of EU Tax Rates

Back to top

| Value Added Tax |

Value Added Tax was first introduced in Cyprus in 1992. Initially, both companies and individuals paid a maximum of 5% VAT; the rate has gradually increased since then, and on January 1st 2003 reached the current rate of 15%.

On May 1st 2004 Cyprus companies became subject to the European Union VAT system. |

| Companies subject to VAT |

The fact that a company is subject to VAT in Cyprus does not necessarily mean that the company is tax resident from the point of view of corporation tax.

Therefore, if a company is registered in Cyprus, but the management takes place outside Cyprus, then the company can, or even must, be subject to the Cypriot, and automatically therefore, EU VAT systems. Foreign companies, on the other hand, can only be subject to Cyprus VAT, if they register premises (a branch) in Cyprus and apply for VAT registration. |

| Tax liability | Any company registered in Cyprus - or foreign company with a branch in Cyprus - is liable for tax in Cyprus, provided that the income liable for VAT in a given financial year reaches or exceeds 9000 Cyprus pounds (CYP). |

| EU VAT number |

Any company registered in Cyprus - or foreign company with a branch in Cyprus - may obtain an EU VAT number in Cyprus.

The application for a VAT number takes a few working days (it is usually the company's accountant in Cyprus who files the application with the tax authorities). |

| VAT returns |

Companies subject to the VAT system are required to prepare quarterly VAT returns and file them with the competent tax authority.

If the amount of VAT payable is higher than the amount being reclaimed, then this must be paid within 40 days. If the amount being reclaimed is greater, then the difference will be transferred by the tax authorities. |

| VAT rates |

- Basic rate 15%

- Reduced rate 5% - Zero rate 0% |

| VAT-free services |

Service providers who provide only VAT-free services are not authorised to deduct or reclaim VAT on acquisitions.

The following services are currently VAT-free: - letting services - medical services - financial and insurance services - real estate transactions (exempt a building, or a part of buildings and the land on which they stand if the application for a building permit was submitted after the 1st May 2004) |

| Zero-rated services |

This covers, for example

- medicines - food and food products (exempt the supply of food in the course of catering) - export products - air and sea transport Distributors of zero-rated products and companies offering zero-rated services can reclaim the VAT paid on acquisitions, or can deduct it from the VAT they have to pay. |

| Products and services subject to reduced rate 5% VAT |

The main services covered in this field typically include the following:

- fees for hotel services - catering services (excluding alcoholic beverages) - undertaking services - fees arising from artistic and performing arts activities |

| Products and services subject to basic rate 15% VAT | Products and services not mentioned above; that is the majority of products and services fall into this category. |

| Expected changes in the future | From January 1st 2008 medicines, catering services and fees for hotel services, which are currently zero-rated, will be subject to the basic rate 15% VAT. Similarly, building land, also currently zero-rated, will be subject to the basic rate of 15% from January 1st 2008. |

| Real estate |

From May 1st 2004, services related to the sale of real estate, including building land, will be subject to VAT as follows:

- 5% on new property - 15% VAT on services related to subsequent sales |

| Trade within the community |

After May 1st 2004 the terms import and export will lose their meaning in regard to the EU member states.

It will only be possible to export to and import from countries outside the EU. Trade between Cyprus and other EU member states will become so-called "intra community supply and intra community acquisition". Cyprus has adopted the use of the general EU regulations with regard to community trade. Accordingly, in the case of sales within the community, if the goods leave one member state and enter another, for sales purposes, then the first member state does not have to charge VAT on the sale of the goods, provided that - the buyer is in possession of a community VAT number - there is documentary proof that the goods left the first country and arrived in the second one. Similarly, in the case of acquisition within the community, VAT is not charged in the country of arrival, provided that - both the buyer and seller have EU VAT numbers and have informed each other of the fact - the goods actually left one country and arrived in the other. |

| Triangular business transactions |

There is a special type of international trading transaction, where companies from three different countries are involved in the trade.

The company buying the goods, acting as an intermediary, buys goods from one country and sells them on to a third country, without the goods ever actually entering the country of the intermediary. In these triangular transactions within the EU, the most favourable situation occurs when all three trading partners possess community VAT numbers, and there is documentary proof that the goods were actually transported from one country to the other for the purpose of being sold. In this case there is no VAT charged on either the acquisition or the sale. Of course, this does not mean that the company in Cyprus is exempt from the preparation of VAT returns. Returns have to be prepared and filed with the tax authorities quarterly in this case too. In a Triangular Transaction simplified procedure can be applied under the following conditions: - All three parties must be registered for VAT purposes in one of the Member States, - The intermediary supplier (Cyprus) must not be registered for VAT in the third Member State (France), where the goods are delivered, - The invoice of the intermediary issued to the Buyer includes the phrase "VAT EU Art.28 Simplified Invoice" The second buyer is registered for VAT purposes in the Country of delivery of the goods (France). |

Individuals subject to taxation

In accordance with the laws of Cyprus a person is subject to personal income tax in Cyprus, whether they are Cypriot citizens or foreigners, if, during a given tax year, they actually spent more than 183 days in Cyprus.

In the case of individuals, the financial year coincides with the calendar year.

Tax resident individuals are required to prepare a tax return in Cyprus on their world-wide income, and to pay the necessary tax. Individuals who are not resident in Cyprus, but who receive income from certain Cypriot sources, are also required to pay tax in Cyprus on this income.

Thus, individuals who are tax resident in Cyprus are subject to tax on both their local and foreign work-related incomes (salaries, commission, etc.).

They are exempt from payment of the full amount of tax, however, on the following:

| Type of Income | Exemption limit |

| Dividends | The whole amount |

| Interest from bank deposits, co-operative institutions or debentures of companies listed on the stock exchange | The whole amount |

| Profits from the sale of securities defined as shares, bonds, debentures, founders' shares and other securities of companies or other legal persons, incorporated in Cyprus or abroad and options thereon | The whole amount |

| Remuneration from any office or employment exercised in Cyprus by an individual who was not a resident of Cyprus before the commencement of his employment. The exemption applies for a period of three years commencing from the 1st January following the year of employment | 20% of income with a maximum amount of CYP5.000 annually |

| Remuneration from salaried services rendered outside Cyprus for more than 90 days in a tax year to a non-Cyprus resident employer or to a foreign permanent establishment of a Cyprus tax resident employer | The whole amount |

| Widows pension | The whole amount |

| Deposits with the Housing Finance Corporation | 40% of the deposited amount, which can not exceed 25% of the individuals total income |

| Profits of permanent establishment abroad unless the permanent establishment directly or indirectly engages more than 50% in activities leading to investment income and the foreign tax burden is substantially lower from the tax burden in Cyprus | The whole amount |

| Lump sum received as a retirement, computation of pension or compensation for death or injuries | The whole amount |

| Income from scholarship or educational donation | The whole amount |

| Capital sum accruing to individuals from any payments to approved funds | The whole amount |

Personal income tax rates in Cyprus are currently as follows:

| TAXABLE INCOME (EURO) | TAX RATE (%) | ACCUMULATED TAX (EURO) |

|---|---|---|

| 0 - 19 500 | 0 | 0 |

| 19 501 - 28 000 | 20 | 1700 |

| 28 001 - 36 300 | 25 | 3775 |

| Over 36 300 | 30 |

In the case of non-Cypriot tax residents, the following payments from Cyprus companies are exempt from tax in Cyprus:

- work-related income (salaries, commission etc.)

- dividend payments.

Special Contribution for Defence

Cyprus tax residents are subject to the "special contribution for defence" to help fund the defence budget (used primarily for manning the buffer zone between the Greek and Turkish areas). Non-tax residents are exempt, and the rates for legal entities are generally nil.

Current rates are as follows:

| TAX RATES | Individuals % | Legal entities % |

| Dividend income from Cyprus resident companies | 15 | Nil |

| Dividend income from non-Cyprus resident companies | 10 | Nil (under conditions) |

| Interest income arising from the ordinary activities or closely related to the ordinary activities of the business | Nil | Nil |

| Other interest | 10 | 10 |

| Rental income (reduced by 25%) | 3 | 3 |

| Profits of semi-government organisations | N/A | 3 |

Any foreign tax paid on income which is subject to Special Contribution for Defense will be given as an allowance against the Cyprus tax even if there is no double tax treaty agreement signed with that country.

Capital Gains Tax is imposed on the disposal of immovable property situated in Cyprus. This also applies to the disposal of shares in companies owning such property, excluding shares listed on any recognised stock exchange. The rate of Capital Gains Tax is currently 20%.

There are exemptions on disposals arising under certain circumstances, such as, for example, transfer arising on death, and gift made between family members.

If you would like to receive more information on this subject, or for a full list of exemptions, please contact our Cyprus office, where our staff will be happy to help.

| Administrative requirements |

In the case of sales within the community, the seller - is required to complete and file with the tax authorities the so-called EC Sales List every quarter, within 40 days of the end of the given quarter. The information contained in these may be used by the tax authorities not only at home, but in cooperation with the authorities of any other member state - must show all sales made in the EU in its local quarterly VAT return - is required to file, for statistical purposes, within ten days of the end of each month the so-called Intrastat document - must show its own and the buyer's EU VAT numbers on sales invoices. In the case of acquisitions within the community, the seller - is required to file within ten days of the end of each month the so-called Intrastat document - must show the amount of acquisitions within the EU in its quarterly VAT return - must inform its EU trading partners of its EU VAT number prior to making the acquisitions. |

| Other regulations |

Special regulations apply to certain products and types of sales. These include, for example

- distance selling - sales of alcoholic beverages - sales of petrol and fuels - sales of coffee and tobacco products. In these cases, special regulations cover the determination, charging and recording of VAT, as well as the preparation of VAT returns. |

| Accounting obligations |

All companies registered in Cyprus, regardless of whether they are tax resident or just subject to VAT, are required to keep accounts in line with the laws of Cyprus, and to report to the authorities. As a full member of the European Union, and despite the fact that it follows British traditions, Cyprus has been continually adopting (and is still adopting) and employing EU accountancy principles and standards.

The corporate documents (that is, copies of the incorporation documents and copies of minutes recording meetings of shareholders and boards of directors) must be kept in the company's registered office, together with the company seal. The company secretary is usually responsible for maintaining records of the owners and directors, and for registering any changes in the company's registers. |

| Reporting requirements |

Changes in any of the following must be registered with the Registrar of Companies:

- directors - owners - company secretary - registered office address Provided that the new details are in accordance with the regulations set down by law, the Registrar of Companies will register the changes in the records, and the changes then become official. As the company records in Cyprus are available to the public, once the changes have been registered, anyone can gain access to the new details of the company. |

| Annual return |

In accordance with Anglo-Saxon traditions, all companies registered in Cyprus are required, once a year, to file a so-called "Annual Return" with the Commissioner of Companies at the Registrar of Companies.

At the time of filing, it is also necessary to attach the required annual fee. The Annual Return is signed and usually filed with the Commissioner by the company secretary. If a company fails to meet its requirements with regard to the filing of an Annual Return, the Commissioner has the right to decide whether or not the company should be stuck off the register of companies. |

| Audited financial report |

All companies registered in Cyprus, regardless of whether they are tax resident or just subject to VAT, are required to file with the tax authorities in Cyprus an audited annual report regarding the given financial year.

The records forming the report may be kept by anyone; they can be kept by a Cypriot or non-Cypriot alike, and could even be kept outside Cyprus. Only auditors registered in Cyprus, however, are authorised to carry out the auditing of the report. In practice the accounts and the audit are very rarely separated, and the accountant in Cyprus who prepares the accounts also carries out the auditing of the report. It is not advisable to separate the two, as a non-Cypriot accountant is unlikely to know all of the accounting rules in Cyprus (for example, deduction of expenses, amortisation etc.), and would be unable, therefore, to keep suitable accounts. The first financial year of a Cyprus company begins on the date of incorporation and it ends on 31st December of the current year. The accounting period is a period of twelve months starting from 1st January. |

| Additional administrative requirements |

Companies have one year from the end of their financial year to prepare the audited financial report.

Typically, therefore, companies have until December 31st of the year following the financial year to file their audited financial report with the tax authorities in Cyprus. Companies must estimate the amount of tax that will be due at the beginning of the financial year, and must make an advance tax payment every quarter. If, as a result, a company pays too much tax, then the tax authorities will refund the difference to the company's bank account following the filing of the financial report. Companies subject to VAT must prepare a statistical "Ecostat" report each month, and file it with the tax authorities by the tenth day of the following month. They must also prepare the following quarterly reports: - VAT return. This must show separately the amounts of any sales and acquisitions within the EU. The return must be filed with the tax authorities within 40 days of the end of the quarter in question. - EC Sales List. This must contain details of any sales made within the EU, and again must be filed within 40 days of the end of the quarter in question. |